A State-by-State Guide to Property Taxes: Understanding the Landscape

Related Articles: A State-by-State Guide to Property Taxes: Understanding the Landscape

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to A State-by-State Guide to Property Taxes: Understanding the Landscape. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A State-by-State Guide to Property Taxes: Understanding the Landscape

Property taxes, a cornerstone of local government funding, vary significantly across the United States. This article provides a comprehensive state-by-state overview of property tax rates, outlining the key factors that influence these rates and exploring the impact on homeowners and the broader economy.

Understanding the Basics

Property taxes are levied on the assessed value of real estate, including land, buildings, and any attached improvements. The assessed value is typically determined by local government assessors, who consider factors such as market value, property size, and location. The tax rate is applied to this assessed value to calculate the annual property tax bill.

Key Factors Influencing Property Tax Rates

Several factors contribute to the wide range in property tax rates across the country:

- Local Government Needs: Property taxes are a primary source of revenue for local governments, funding essential services such as education, police and fire departments, infrastructure, and public parks. The demand for these services, coupled with local budgets, influences tax rates.

- Property Values: Areas with higher property values generally have higher property taxes, as the tax base is larger. Conversely, areas with lower property values tend to have lower property taxes.

- Tax Assessment Practices: The methodology used to assess property values can significantly impact tax rates. Some states have stricter assessment standards than others, leading to variations in assessed values and subsequent tax bills.

- State Laws and Regulations: State laws govern property tax rates and assessment practices, setting limits and guidelines for local governments. These regulations can influence the overall property tax burden.

- Economic Factors: Economic conditions, including employment rates, housing markets, and local development, can impact property values and, consequently, tax rates.

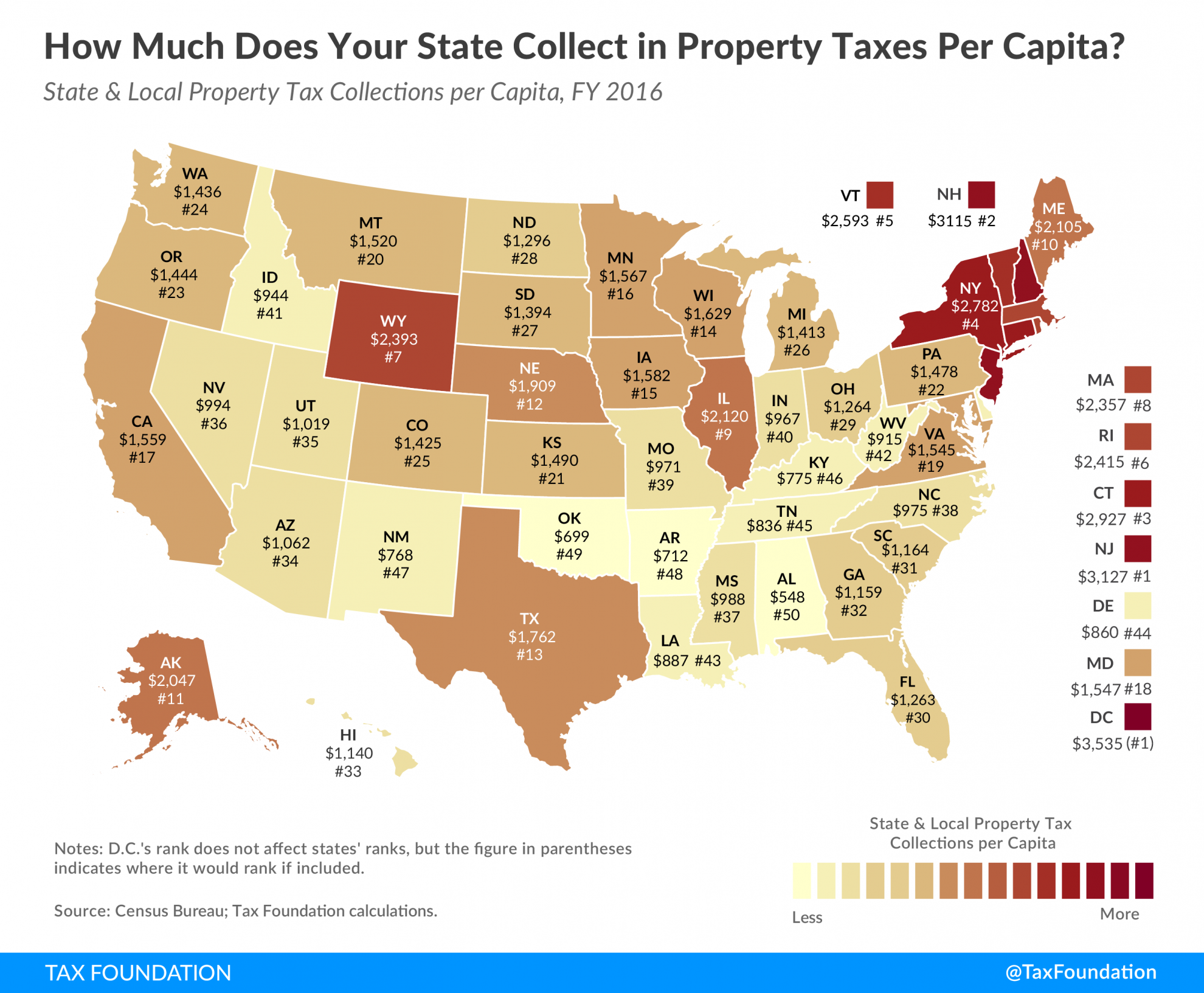

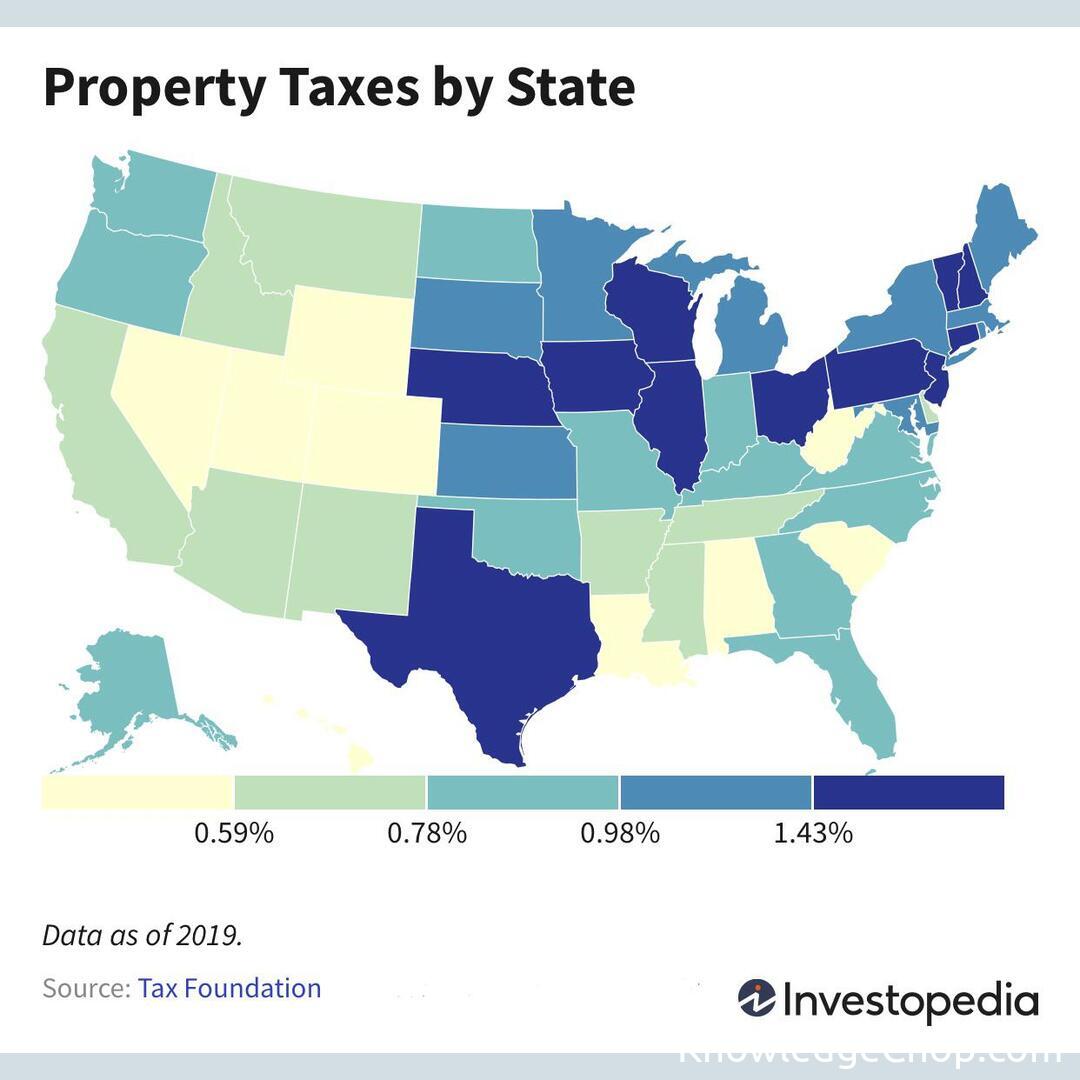

State-by-State Overview

The following table provides a snapshot of property tax rates across the United States, focusing on the effective tax rate, which represents the actual amount of property tax paid as a percentage of the property’s market value:

| State | Effective Property Tax Rate |

|---|---|

| Alabama | 0.57% |

| Alaska | 0.14% |

| Arizona | 0.77% |

| Arkansas | 0.65% |

| California | 0.75% |

| Colorado | 0.58% |

| Connecticut | 1.87% |

| Delaware | 0.91% |

| Florida | 0.96% |

| Georgia | 0.85% |

| Hawaii | 0.37% |

| Idaho | 0.63% |

| Illinois | 1.23% |

| Indiana | 0.99% |

| Iowa | 0.97% |

| Kansas | 0.81% |

| Kentucky | 0.83% |

| Louisiana | 0.54% |

| Maine | 1.52% |

| Maryland | 0.78% |

| Massachusetts | 1.25% |

| Michigan | 1.05% |

| Minnesota | 0.94% |

| Mississippi | 0.52% |

| Missouri | 0.72% |

| Montana | 0.61% |

| Nebraska | 0.89% |

| Nevada | 0.59% |

| New Hampshire | 1.68% |

| New Jersey | 2.25% |

| New Mexico | 0.68% |

| New York | 1.47% |

| North Carolina | 0.79% |

| North Dakota | 0.55% |

| Ohio | 1.02% |

| Oklahoma | 0.74% |

| Oregon | 0.92% |

| Pennsylvania | 1.21% |

| Rhode Island | 1.61% |

| South Carolina | 0.58% |

| South Dakota | 0.62% |

| Tennessee | 0.69% |

| Texas | 1.84% |

| Utah | 0.66% |

| Vermont | 1.73% |

| Virginia | 0.73% |

| Washington | 0.71% |

| West Virginia | 0.76% |

| Wisconsin | 1.14% |

| Wyoming | 0.48% |

Important Considerations

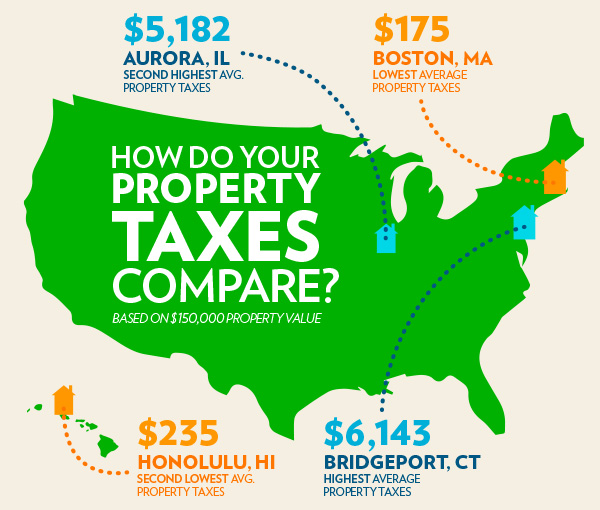

While this table provides a general overview, it is crucial to remember that property tax rates can vary significantly within a state, depending on factors such as local government needs, property values, and assessment practices. It is essential to consult local tax records for specific information on property tax rates in a particular area.

Benefits and Impacts of Property Taxes

Property taxes play a vital role in funding local government services. Their benefits include:

- Funding Essential Services: Property taxes provide a stable and predictable source of revenue, ensuring the continued delivery of essential services such as education, public safety, and infrastructure.

- Local Control: Property taxes empower local communities to determine their own priorities and fund services that meet their specific needs.

- Economic Stability: Property taxes contribute to the economic stability of local communities, supporting infrastructure development, attracting businesses, and maintaining property values.

However, property taxes can also have negative impacts:

- Financial Burden: For homeowners, property taxes can represent a significant financial burden, particularly for those on fixed incomes or living in areas with high property values.

- Disproportionate Impact: Property taxes can disproportionately impact low-income homeowners, who may have a higher percentage of their income dedicated to property taxes.

- Property Value Fluctuations: Fluctuations in property values can lead to unpredictable tax bills, making it difficult for homeowners to budget for these expenses.

FAQs on Property Tax Maps

1. What is a property tax map?

A property tax map is a visual representation of property tax rates and assessed values across a specific geographical area, such as a county or city. These maps typically use color-coding or other visual cues to highlight areas with higher or lower tax rates.

2. What is the purpose of a property tax map?

Property tax maps serve several purposes:

- Transparency and Accountability: They provide transparency into how property taxes are levied and distributed, increasing accountability for local governments.

- Comparative Analysis: They allow homeowners to compare property tax rates in different areas, aiding in real estate decisions.

- Community Planning: They can help local governments identify areas with high or low property tax burdens, informing planning decisions.

3. How can I access a property tax map?

Property tax maps are typically available through local government websites, assessor’s offices, or online real estate platforms.

4. What information is typically included on a property tax map?

Property tax maps typically include information such as:

- Assessed value: The estimated value of properties for tax purposes.

- Tax rate: The amount of tax levied per $100 of assessed value.

- Property tax bill: The total amount of property tax owed.

- Property boundaries: The geographical boundaries of properties.

- Land use: The type of land use, such as residential, commercial, or industrial.

Tips for Understanding Property Tax Maps

- Pay attention to the scale: Ensure you understand the scale of the map to accurately interpret the data.

- Consider the data source: Verify the source of the data and its reliability.

- Compare multiple maps: Compare maps from different sources to get a more comprehensive understanding of property tax rates.

- Contact local officials: If you have questions or need clarification, contact local government officials or the assessor’s office.

Conclusion

Property tax maps provide valuable insights into the distribution of property taxes across a specific area. They offer transparency, facilitate comparative analysis, and support community planning. Understanding the information presented on these maps can empower homeowners and contribute to informed real estate decisions and local policy discussions.

Closure

Thus, we hope this article has provided valuable insights into A State-by-State Guide to Property Taxes: Understanding the Landscape. We appreciate your attention to our article. See you in our next article!