Understanding USDA Loan Map Eligibility: A Guide to Rural Homeownership

Related Articles: Understanding USDA Loan Map Eligibility: A Guide to Rural Homeownership

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding USDA Loan Map Eligibility: A Guide to Rural Homeownership. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding USDA Loan Map Eligibility: A Guide to Rural Homeownership

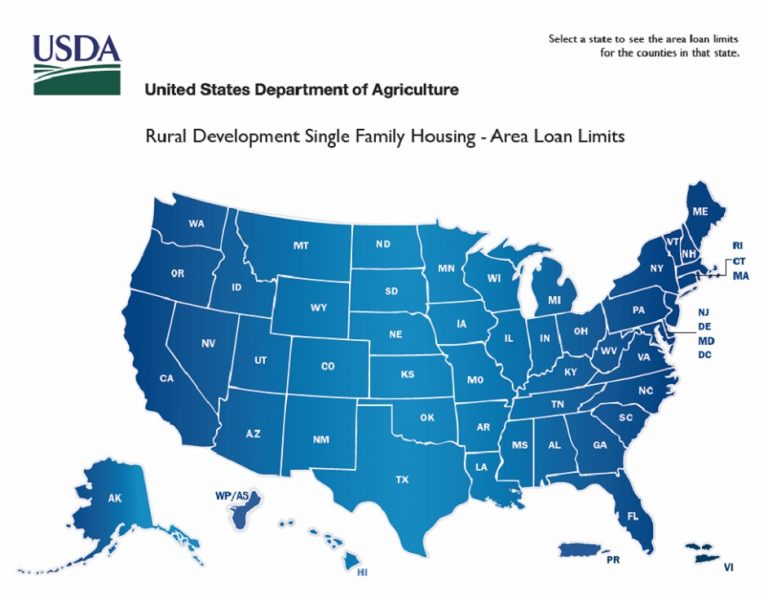

The United States Department of Agriculture (USDA) offers a unique financing program designed to assist eligible individuals in purchasing homes in rural areas. The program, known as the USDA Rural Development Housing Loan Program, provides government-backed mortgages with favorable terms, often including lower interest rates and down payment requirements compared to conventional loans.

Delving into the Eligibility Criteria: The USDA Loan Map

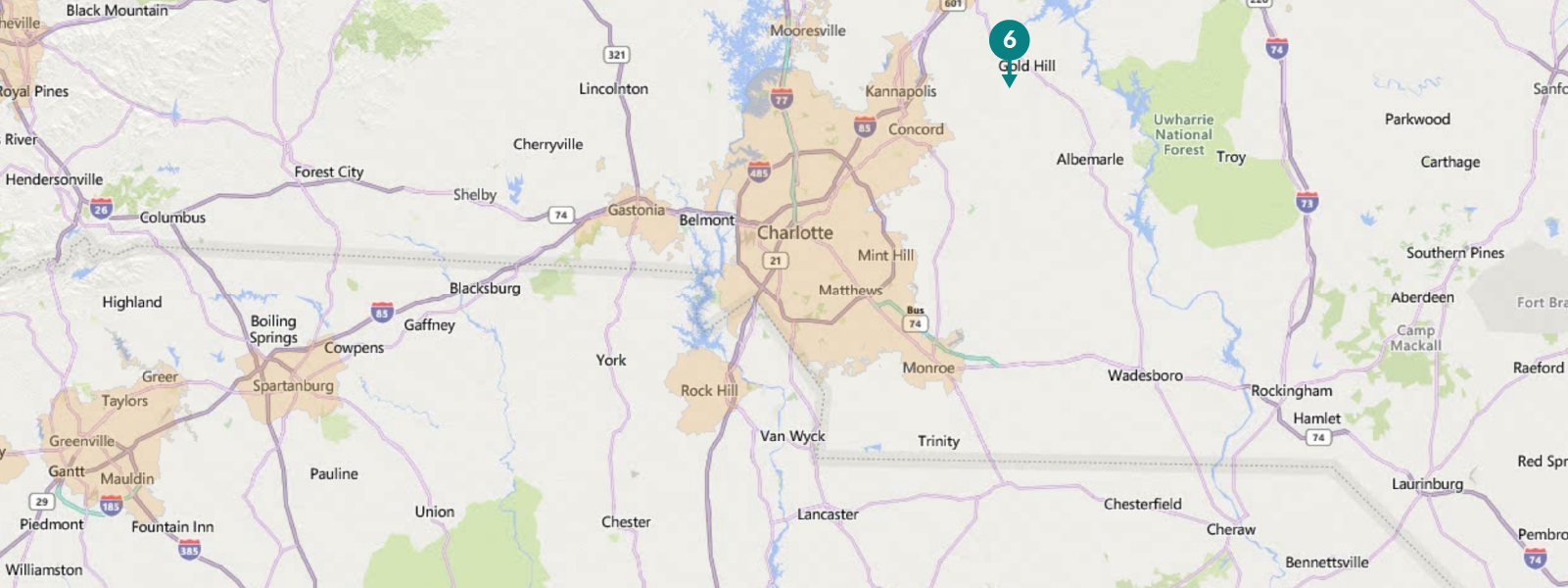

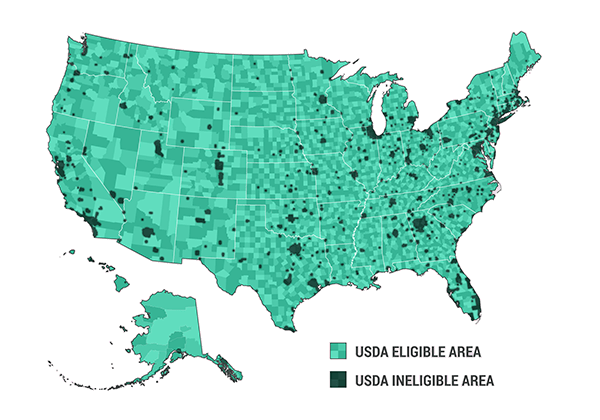

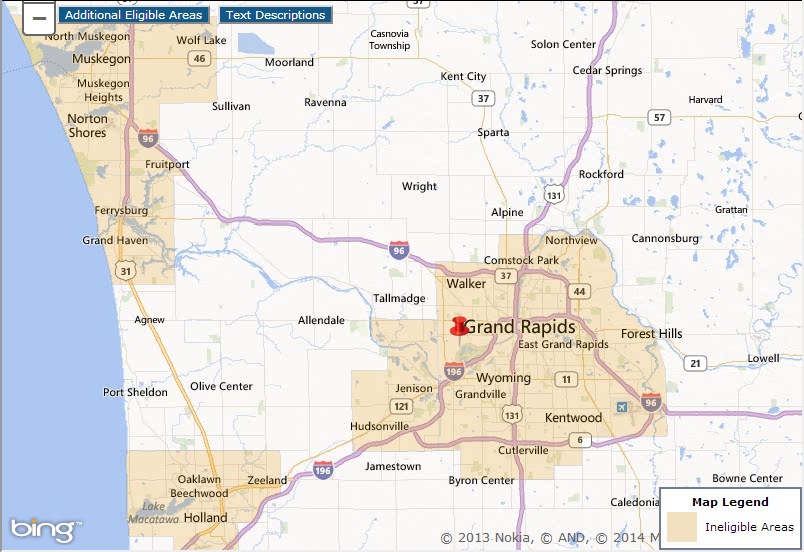

Central to accessing this program is the USDA Loan Map, a vital tool that delineates eligible areas for USDA financing. The map, accessible online through the USDA Rural Development website, is a geographically-based tool that indicates areas designated as rural by the USDA.

Key Factors Determining Eligibility:

The USDA considers several factors when determining if an area qualifies for its loan program:

- Population Density: Areas with a lower population density are generally more likely to be designated as rural.

- Proximity to Urban Areas: The USDA considers the proximity of a location to larger cities and towns, with areas further removed from urban centers typically considered more rural.

- Economic Factors: The USDA assesses the economic characteristics of a region, including employment opportunities and income levels.

- Infrastructure: The availability of essential infrastructure, such as water and sewer systems, plays a role in eligibility.

The Importance of the USDA Loan Map:

Understanding the USDA Loan Map is crucial for prospective homeowners seeking to utilize the program. It provides a clear visual representation of eligible areas, allowing individuals to determine if their desired location qualifies for USDA financing.

Navigating the USDA Loan Map:

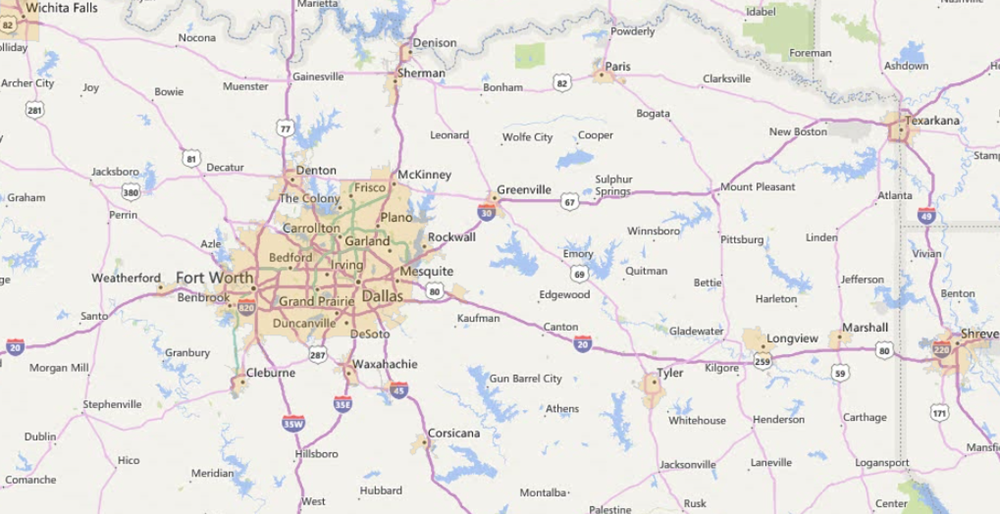

The USDA Loan Map is user-friendly and straightforward to navigate. Users can easily zoom in and out of specific areas, search by address, or explore a county or state. The map provides a visual representation of eligible areas, typically marked in green, while ineligible areas are denoted in gray.

Benefits of Utilizing the USDA Loan Map:

- Strategic Home Search: The map empowers potential homebuyers to focus their search on areas where USDA financing is available, streamlining the home-buying process.

- Financial Advantages: By identifying eligible areas, individuals can access the benefits of USDA loans, including lower interest rates and down payment requirements, potentially saving them significant costs.

- Community Development: The USDA Loan Map facilitates the expansion of homeownership opportunities in rural communities, contributing to economic growth and development.

Frequently Asked Questions (FAQs) Regarding the USDA Loan Map:

Q: What if my desired location is not on the USDA Loan Map?

A: If your preferred location is not designated as eligible on the map, it is still possible to explore other options. The USDA may occasionally make exceptions, particularly in areas with unique circumstances. It is recommended to consult with a USDA-approved lender to discuss your specific situation.

Q: Can the USDA Loan Map change over time?

A: Yes, the USDA Loan Map is periodically updated to reflect changes in population density, economic conditions, and other relevant factors. It is advisable to check the map regularly to ensure you have the most up-to-date information.

Q: Does the USDA Loan Map apply to all types of properties?

A: While the map primarily focuses on single-family homes, it also applies to certain multi-family properties, including duplexes and townhomes. It is important to verify the specific eligibility criteria for your desired property type.

Tips for Utilizing the USDA Loan Map:

- Thorough Research: Before embarking on a home search, thoroughly explore the USDA Loan Map to identify eligible areas that align with your preferences and needs.

- Consult a Lender: Reach out to a USDA-approved lender to discuss your specific situation and obtain guidance on navigating the USDA Loan Program.

- Explore Local Resources: Contact local real estate agents or community development organizations for insights on eligible areas and available housing options.

Conclusion:

The USDA Loan Map serves as a valuable tool for individuals seeking to purchase homes in rural areas. By understanding the criteria used to define eligible areas and leveraging the map’s functionalities, potential homebuyers can effectively identify locations where they can benefit from USDA financing. This program not only facilitates homeownership but also contributes to the growth and development of rural communities across the nation.

Closure

Thus, we hope this article has provided valuable insights into Understanding USDA Loan Map Eligibility: A Guide to Rural Homeownership. We appreciate your attention to our article. See you in our next article!